You're probably thinking that you need to invest in some risky stuff: penny stocks, leveraged funds, unknown companies, right?

Well, actually we use the largest ETFs which are very common and are traded everyday.

Do you think we used leverage or buying on margin in order to increase the results?

We didn't have to use any leverage or borrowing since our growth already beats the typical benchmarks.

This also saves us interest costs.

You may be thinking if these strategies are so rewarding, then why don't the banks use them themselves?

They cannot, but they wish they could!

You see they aren't nimble enough since they have too much capital to invest and cannot move it quickly enough between different investments.

But smaller investors are able to catch the rising trend and maximize their profits.

Are you concerned that these strategies only work in bull markets?

Global Strength Portfolios were engineered to work in all market conditions, either by moving into assets that are going up or moving defensively to cash to ride out the market crashes.

Are you afraid that you don't have enough time to do this?

All our strategies can be managed in less than 5 minutes per month.

We even provide a tool that makes this very easy.

Do you think that this won't work for you?

Our Global Strength strategies can be implemented from anywhere in the world, from any brokerage, in any account. If you have access to the internet, you can do it.

You may be wondering if I invest my own money in these strategies?

You bet I am!

I use all of these strategies in different investment accounts: my retirement account, my kids' education account, my wife's retirement account, and in my non-registered account.

That's why there are 3 different versions of the Global Strength portfolios - to tailor it to your specific accounts and investment time horizons.

Why not just invest in Betterment, Wealthfront or other Robo-advisors?

Because they will invest your money passively into index funds or ETFs according to a static asset allocation.

This means your wealth will grow much, much slower and it will be at the mercy of stock market crashes.

This membership is actually an investment in your financial freedom.

How you ask?

See below...

Looking at the value proposition on the upside

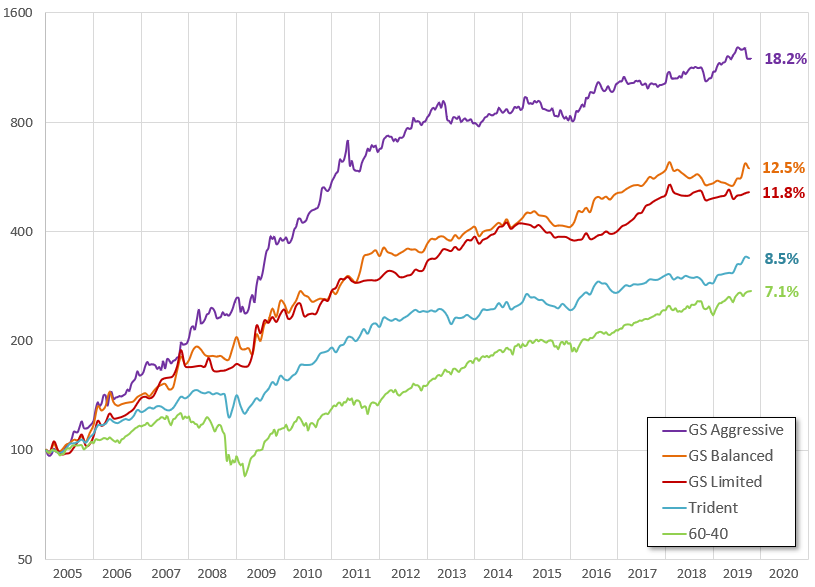

Assume you invested $100,000 in January 2005 in each strategy and you didn't add any more money into them since...